And, the WSL valued, according to court docs in 2016, at $US600 million!

A little history.

The ASP was acquired in 2013 by Zosea Media, a startup owned by Paul Speaker and Terrance Hardy.

Speaker and Hardy were the original architects of the WSL we so love today, becoming controlling owners of the new joint venue along “with the billionaire who invested all $25 million of its capitalization.”

I assume you can guess who this mysterious “billionaire” might be.

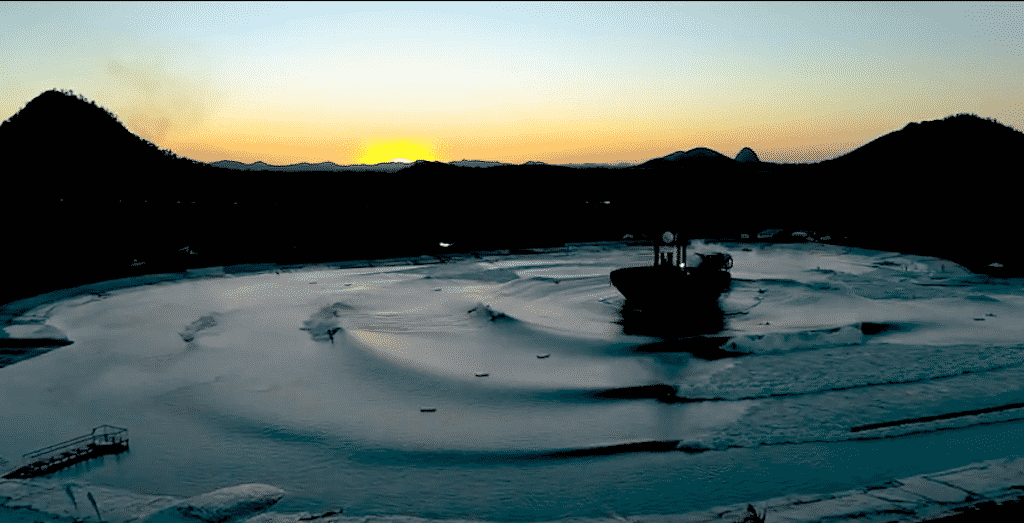

In 2016, the WSL was merged with the Kelly Slater Wave Company.

After the merger, the new venture was valued at $600 million, allegedly resulting in Zosea’s 50% share tripling from $100 million to $300 million.

It’s also alleged that after the acquisition of KSWC, “the billionaire investor would have invested approximately $50 million into the combined company, and it was natural that he expected Zosea to relinquish its voting control over the combined venture.”

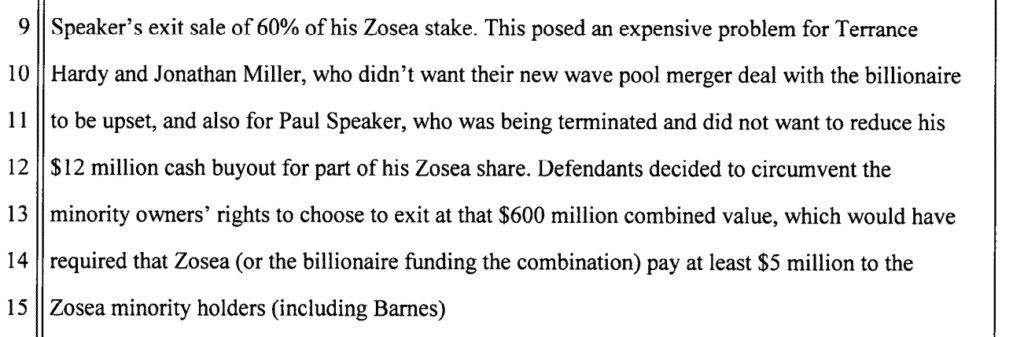

In 2016, Paul Speaker was terminated as the CEO of the WSL, with approval of Hardy and Zosea chairman Jonathan Miller. Speaker allegedly negotiated an exit deal that included selling 60% of his Zosea stake back to Zosea, which Zosea sold back to the billionaire, effectively reducing its ownership share.

Zosea then paid out $12 million to Paul Speaker.

According to a complaint filed in 2017 by the Barnes Firm, a personal injury law firm, a year before the 2016 acquisition of KSWC, Michael Barnes, the owner of the Barnes Firm, and two other persons had been admitted as small equity owners of Zosea in 2015 in return for providing legal services.

Barnes alleged that the small equity owners posed a significant problem to Zosea, as they could have upset the new merger deal or the $12 million buyout.

Barnes also claimed that he had contractual rights to be bought out “upon a change of control of Zosea . . . and also the right to tag-along in exit sales.”

Hardy, Miller, and Speaker allegedly circumvented the minority owners’ right to exit “at that $600 million combined value” and thus circumvented paying “at least $5 million to the ZoSea minority holders.”

According to Barnes, Zosea concealed the change of ownership and Speaker’s exit deal from the minority owners.

In 2017, Barnes initiated arbitration against Zosea, which allegedly prompted them to claim “that Barnes was not entitled to any documents because of some nebulous ‘malpractice’ and ‘conflict’ by Barnes.”

The alleged malpractice was attributed to Barnes having become a member of Zosea.

In response, Barnes brought suit in California state court.

Zosea, Hardy, Speaker, and Miller filed a cross complaint against Barnes in January 2018, alleging breaches of ethical duty, fiduciary duty, and legal malpractice. They alleged that after closing the deal, Barnes “conditioned the release of the deal documents and his future legal work on obtaining a larger percentage interest in Zosea, effectively holding the deal hostage.”

They also claimed that after the deal was closed, they had to obtain additional counsel to rectify Barnes’ errors.

Zosea sought to rescind the issuance of Barnes’ ownership and take the case to arbitration.

The parties agreed to confidential arbitration in April 2018, so much of the litigation is not public.

On August 19, 2020 the parties settled for an unknown amount.

Read Michael Barnes vs Zosea etc here. A surprisingly fascinating twenty-one page read.