Yesterday's bargain is today's millstone!

Just two days ago, I opined that at ten cents apiece maybe SurfStitch shares were the deal of a lifetime. Afterall, only eighteen months earlier they cost two bucks.

By my flawed rationale, five grand would buy what was worth a hundred gees only eighteen months earlier. It was like an almost new Bentley had suddenly appeared for sale at a giveaway price. And, conventional, if ballsy, wisdom is to buy in when everybody else is cashing out.

Buy, buy, buy!

Of course, the market usually knows best. If you’d followed my course your ten cent shares would be worth seven cents. A thirty per cent hit in two days.

And, today, after a $100 million class action was launched by aggrieved shareholders, trading in SurfStitch shares was halted. So even if you want to cut your losses you can’t.

From the Biz Insider:

The class action launched by lawyers Quinn Emanuel claims SurfStitch was trading at a loss when it announced in 2015 that it was expecting earnings to double in the 2016 year.

SurfStitch is accused of misleading and deceptive conduct and breaching its continuous disclosure obligations

The company’s shares fell 9% yesterday to close at $0.068, well down on the record high of $2.09 and the $1 list price in 2014.

SurfStitch on Monday announced another profit downgrade, saying full year losses are now expected to be about double the size since the last estimate in February.

The company is now forecasting an underlying EBITDA (earnings before interest, tax, depreciation and amortisation) loss for the full year of between $10.5 million to $11.5 million, a sharp deterioration from the $5 million to $6.5 million forecast in February and the previous estimate of a $4 million to $5 million loss.

(Read the rest of that story here.)

The Australian Financial Review, meanwhile, wrote about a seventy-eight-year-old man who was so dazzled by SurfStitch’s promises of riches he poured his cash into the online retailer.

A 78-year-old retiree who has seen the value of his shares in SurfStitch Group plunge 92 per cent is the lead plaintiff in a $100 million class action claim.

Warwick Cook and his wife Leonee bought their first 5000 shares in SurfStitch in November 2015, paying $2.12 a share, more than double SurfStitch’s issue price less than 12 months earlier.

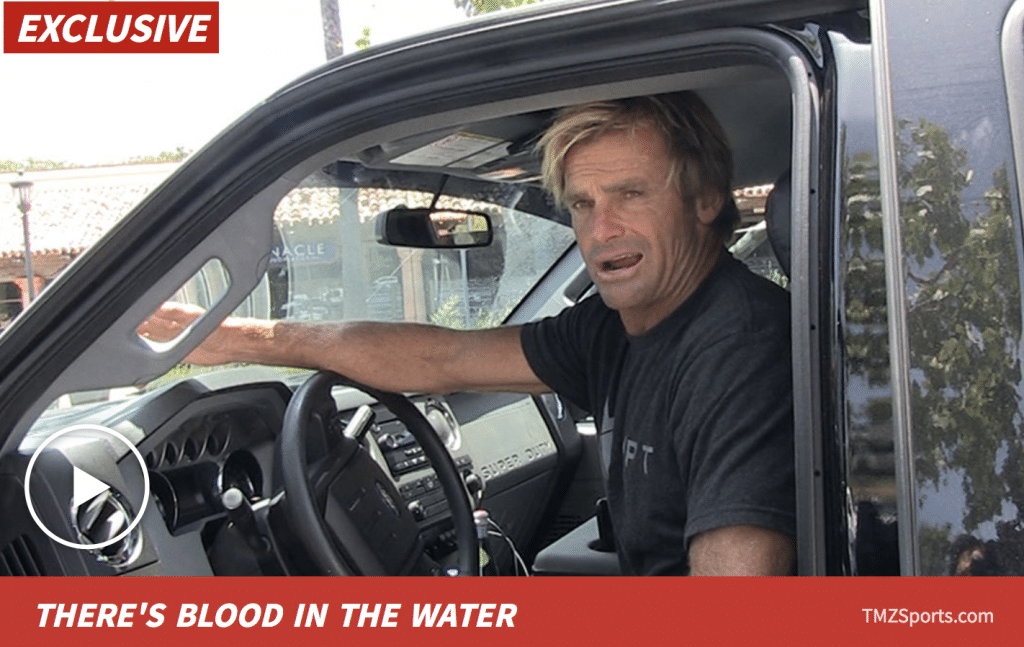

The Cooks were encouraged by repeated forecasts by SurfStitch’s co-founder and chief executive Justin Cameron that earnings were expected to more than double in 2016, to between $15 million and $18 million.

Mr Cook bought another 5000 shares in December 2015 after SurfStitch announced a share placement to fund the acquisition of a surf accessories business, Surf Hardware, and upped its profit guidance to between $18 million and $22 million.

And,

Mr Cook snapped up another 25,000 shares in May 2016 at 49¢ after SurfStitch downgraded guidance to between $2 million and $3 million, citing a reorganisation triggered by Mr Cameron’s surprise resignation in March.

A month later, in June 2016, SurfStitch reversed the $20.3 million transaction, leading to an $18.8 million loss. SurfStitch shares plunged 50 per cent to 18.5¢ and continued to lose ground, closing on Tuesday at a record low of 6.8¢.

The sharemarket is as fascinating as it is gruesome, don’t you think?