To Stab! What a world we live in!

Remember those heady internet bubble years when money flowed like tap water and Netscape I mean AOL I mean Surfstitch ruled all? There were no losers only green green pastures filled with suckers I mean investors I mean you. Just kidding. You never invested.

Well, the damn bubbles always burst. Netscape turns dumb, AOL turns old and Surfstitch turns what the hell. Two years ago, Australia’s online surfwear retail giant was high and scooping up businesses at a wild clip. Millions for FCS. Millions for Magic Seaweed. Millions for Stab. Now they are dumping assets like old Halloween candy. It was rumored that Stab was even being shopped for running costs.

Well guess what? Surfstitch found a buyer and you’ll never guess who. Let’s let the Australian Financial Review to see.

Embattled online retailer SurfStitch has sold Rollingyouth, the owner of Stab Magazine, back to its co-founders for a nominal sum after splashing out almost $6 million for the Bondi-based publisher during an ill-fated acquisition spree.

The administrators of SurfStitch Group, John Park, Quentin Olde and Joseph Hansell of FTI Consulting, announced the sale of Rollingyouth Pty Ltd on Monday, almost three weeks after SurfStitch was placed into voluntary administration to buy breathing space from creditors and legal foes.

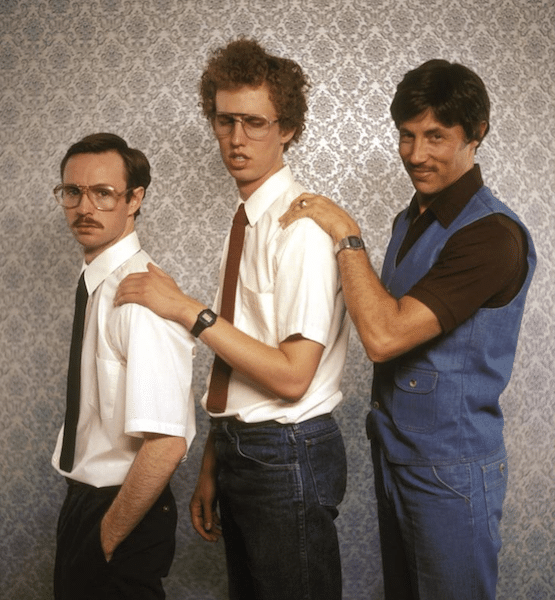

Mr Park said Rollingyouth, which trades as Stab Magazine, had been sold to Rollingyouth Media Pty Ltd, a company owned by Stab co-founders Sam McIntosh and Tom Bird for a nominal cash consideration. Discussions had been underway for months before SurfStitch went into administration.

Mr McIntosh and Mr Bird sold the business to SurfStitch in May 2015 for $2.26 million in cash and 2.43 million SurfStitch shares worth $3.6 million at the time. The shares vested in three tranches in May 2016, May 2017 and May 2018.

Those shares are now worthless unless creditors approve proposed offers to restructure and relist the company under a deed of company arrangement.

Mr Park said SurfStitch Group and Rollingyouth Media would maintain a close commercial relationship, with both parties entering into a three-year agreement for the supply of marketing and content development and advertising services to the SurfStitch Group.

Rollingyouth is the third asset sold at a big discount to its purchase price by SurfStitch’s new board and management team, led by chairman Sam Weiss and chief executive Mike Sonand.

Between December 2014 and December 2015, SurfStitch outlaid more than $120 million in cash and shares on five acquisitions, including $24 million for Surf Hardware International, $5.8 million for Stab, an online surf content platform, $8.5 million cash and 2.29 million shares for UK-based surf forecaster Magicseaweed, and $15 million for Garage Entertainment, which made action sports films and videos.

SurfStitch co-founders Justin Cameron and Lex Pedersen wanted SurfStitch to become the Amazon Prime of the action sports world, using unique content to attract customers and keep them engaged.

However, shareholders started questioning the strategy after Mr Cameron backed away from earnings guidance in February 2016.

Mr Cameron quit unexpectedly a month later to purportedly pursue a private equity-backed privatisation, which never eventuated.

Within months of Mr Cameron’s departure, SurfStitch’s new board and management started revaluing the acquisitions, writing down the value of goodwill for Rollingyouth, Garage Entertainment, Surf Hardware and Magicseaweed by $28 million.

SurfStitch sold Garage Entertainment in April to Madman Entertainment for a nominal sum after writing down the value of goodwill by $12.9 million, while Surf Hardwear International was sold in December for $17 million cash to Gowing Bros.

Negotiations are also believed to be underway for the sale of Magicseaweed.

Mr Pedersen left SurfStitch shortly before the appointment of administrators last month and is believed to be involved in a new digital venture dubbed Periscope with two other SurfStitch executives, former global marketing director Martin Corr and head of business intelligence Clover Chambers.

Based in Mona Vale in Sydney’s Northern Beaches, Periscope will provide strategy, consulting, infrastructure and services to other e-commerce businesses, according to Mr Corr’s LinkedIn profile.

SurfStitch shares were trading at 6.8?? before the stock was suspended in June – a fraction of their December 2014 issue price of $1 and the $2 some shareholders paid in a capital raising in November.

Surprised? Happy?

Viva the little man and welcome back to private ownership dear Stab. The water is warm!